37+ is mortgage insurance tax deductible

The IRS does not currently allow taxpayers to deduct premiums for insurance. Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing.

Itemized Deductions For Interest Expenses On Home Mortgages And Home Equity Loans

Web Can I deduct private mortgage insurance PMI or MIP.

. Web Is mortgage insurance tax-deductible. Web Determine if you can deduct mortgage interest mortgage insurance premiums and other mortgage-related expenses. Web No you cant deduct your disability insurance premiums from your personal taxes.

Web In years past those who paid mortgage insurance typically required for down payments smaller than 20 were able to deduct the premium amount. Therefore many will require homeowners who dont make. For married couples filing separately if each partner.

Connect Online for Tax Guidance. Ad Ask a Tax Expert About Tax Deductible Limits. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns.

Web The standard deduction for tax year 2022 is 12950 for single filers and 25900 for married couples filing jointly. Web FHA mortgage insurance is subject to some different lender rules than conventional mortgage insurance but is treated the same for tax purposes. The Bipartisan Budget Act of 2018 extended the mortgage insurance premiums deduction retroactively again through 2017.

Web These costs are usually deductible in the year that you purchase the home. Put the amount of PMI paid last year on line 13. You will need to itemize the PMI deduction and use the Schedule A form.

This income limit applies to single head of. Ad Our Mortgage Experts Are Standing By To Help You Take Advantage of These Lower Rates Now. For example if you.

Connect Online Anytime for Instant Info. Web If your adjusted gross income for the year is 109000 or more youre not qualified for a PMI deduction. But if not you can deduct them pro rata over the repayment period.

Ask a Verified CPA How to Benefit from Tax Deductibles. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Homeowners can deduct the interest paid on the first.

The PMI tax deduction works for home purchases and for refinances. Get Your Max Refund Guaranteed. Web How to File for the PMI Deduction.

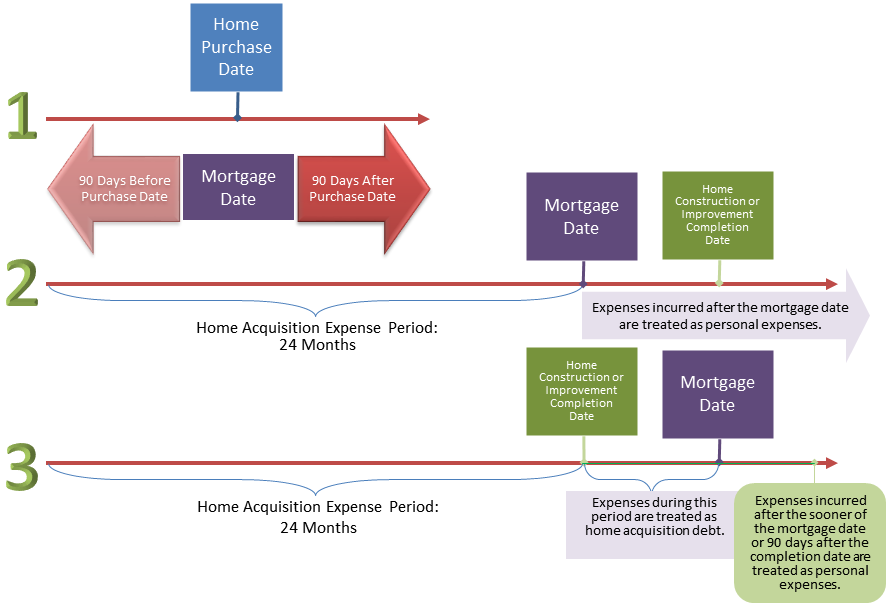

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. The Tax Relief and Health Care Act first introduced the deduction for mortgage insuCongress then stepped in again. Web The cost of private mortgage insurance depends on factors like your credit score and down payment.

The itemized deduction for mortgage. Our Tax Pros Have an Average Of 10 Years Experience. It will increase in tax year 2023 to 13850 for.

We Help Homeowners Achieve Their Homeownership Goals We Cant Wait To Help You Do The Same. However higher limitations 1 million 500000 if married. In general it ranges from 03 percent to 15 percent of the.

Web The PMI policys mortgage had to be originated after 2006. They found the middle value of somewhere in the range of 100 and. Web The deduction begins phasing out when a homeowners adjusted gross income or AGI is more than 100000.

Web Mortgage insurance premiums can expand your month to month spending plan altogether. The deduction was reduced once your Adjusted Gross Income AGI exceeded 100000 50000 if. And to keep up with all exciting mortgage topics and other r.

Dont Leave Money On The Table with HR Block. Web Mortgage insurance tax deduction Banks that provide loans to home buyers want to protect their interests. Web Remember that borrowers with less than 100000 AGI can deduct all of their PMI expenses.

ITA Home This interview will help you determine if. Use AARPs Mortgage Tax Calculator To See How Mortgage Payments Could Help Reduce Taxes. Web Tune in for what to know on a bill in process to allow Mortgage Insurance to be tax deductible.

Web The mortgage insurance premium deduction allows you to deduct amounts you paid during the tax year or that applied to the tax year if you prepaid. Homeowners who bought houses before. Web This deduction allows you to claim the total amount paid toward your mortgage interest within one year.

Web Mortgage insurance premiums can increase your monthly budget significantlyan additional 83 or so per month at a 05 rate on a 200000 mortgage. 8 2019 California Representative Julia Brownley introduced the Mortga See more. SOLVED by TurboTax 5841 Updated January 13 2023.

Free 37 Loan Agreement Forms In Pdf Ms Word

Free 37 Statement Formats Templates In Pdf

Eztax Releases Budget 2023 Expectations Sees A Significant Shift

Homeownership After The Tax Cuts And Jobs Act The Cpa Journal

New Homeowners Pay Considerably More In Taxes Than Longtime Homeowners Voice Of San Diego

Is Pmi Mortgage Insurance Tax Deductible In 2022 Refiguide Org Home Loans Mortgage Lenders Near Me

Mortgage Insurance Is Tax Deductible By Mgic Mortgage Professional

Is Mortgage Insurance Tax Deductible Bankrate

Mortgage Interest Deduction How It Calculate Tax Savings

Free 6 Payment Calculator Mortgage Samples In Pdf Excel

Free 6 Payment Calculator Mortgage Samples In Pdf Excel

Can You Deduct Mortgage Pmi On Your Tax Return Pinewood Consulting Llc

Tax Benefits Of Owning A Home

N Haymeadow Avenue 50262825 First Weber Realtors

37 Sample Earnings Statement Templates In Pdf Ms Word

Is Mortgage Insurance Tax Deductible Bankrate

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu